wake county nc sales tax calculator

All numbers are rounded in the normal fashion. Within Wake Forest there are around 2 zip codes with the most populous zip code being 27587.

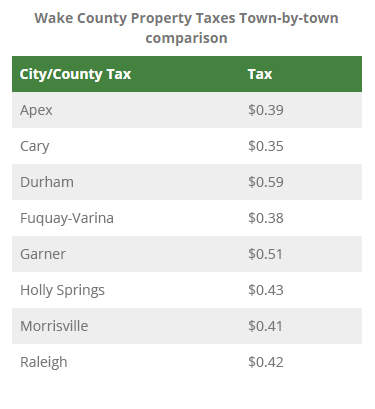

North Carolina Income Tax Calculator Smartasset

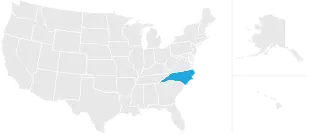

The median property tax on a 22230000 house is 180063 in Wake County.

. This takes into account the rates on the state level county level city level and special level. The Wake County sales tax rate is 2. The average cumulative sales tax rate in the state of North Carolina is 694.

2020 rates included for use while preparing your income tax deduction. Sales Tax Calculator Sales Tax Table. You can find more tax rates and allowances for Wake County and.

US Sales Tax Rates NC Rates Sales Tax Calculator Sales Tax Table. Average Local State Sales Tax. The Wake Crossroads sales tax rate is.

This calculator is designed to estimate the county vehicle property tax for your vehicle. How to calculate taxes Tax rates are applied against each 100 in value to calculate taxes due. This rate includes any state county city and local sales taxes.

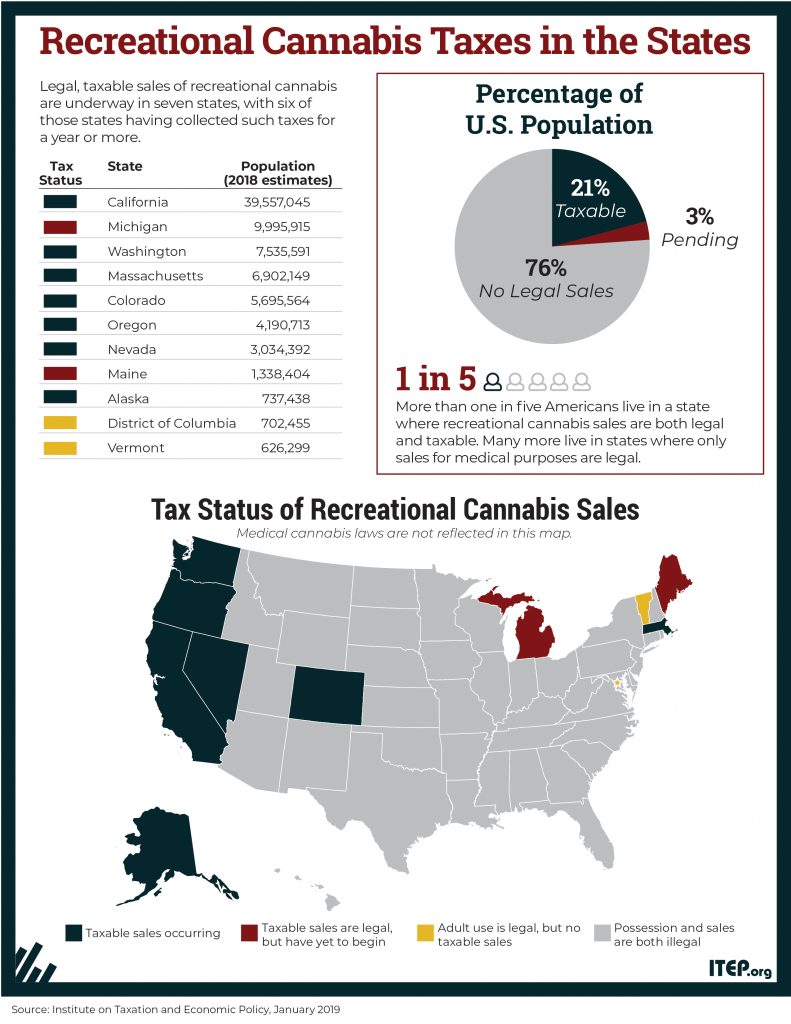

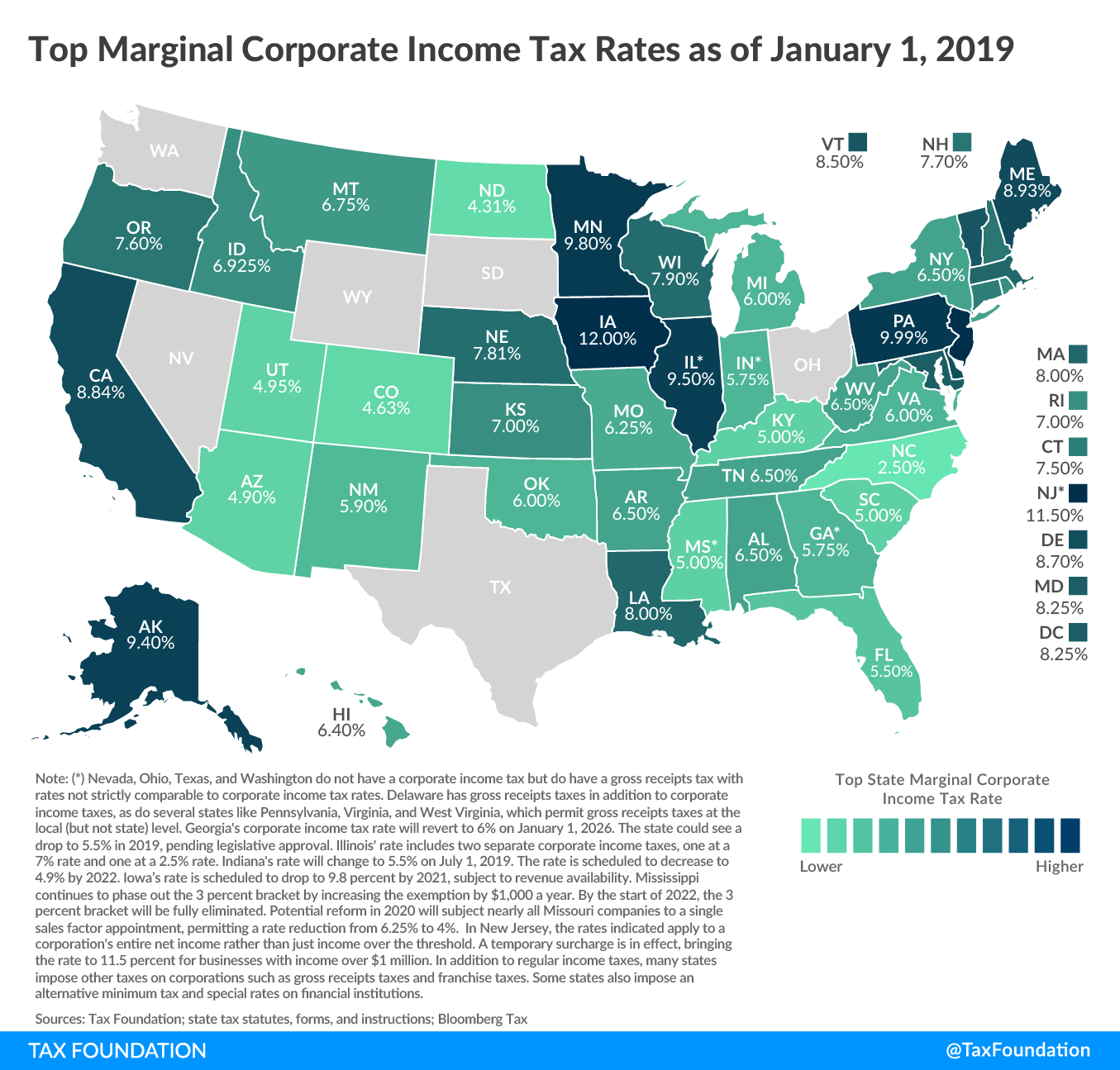

The north carolina nc state sales tax rate is currently 475. The 2018 United States Supreme Court decision in South Dakota v. The Wake County Sales Tax is collected by the merchant on all qualifying.

The latest sales tax rate for Wake Forest NC. Prepared Food Beverage Division. Wake county nc sales tax calculator Thursday August 4 2022 Edit.

This is the total of state county and city sales tax rates. This rate includes any state county city and local sales taxes. Wayfair Inc affect North Carolina.

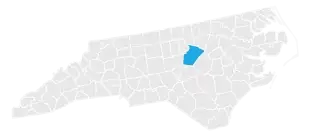

Avalara provides supported pre-built integration. Please enter the following information to view an estimated property tax. The most populous county in North Carolina is Wake County.

North Carolina State Sales Tax. The Wake County North Carolina sales tax is 725 consisting of 475 North Carolina state sales tax and 250 Wake County local sales taxesThe local sales tax consists of a 200 county sales tax and a 050 special district sales tax used to fund transportation districts local attractions etc. Wake county nc sales tax calculator.

The sales tax rate for Wake County was updated for the 2020 tax year this is the current sales tax rate we are using in the Wake County North Carolina Sales Tax Comparison Calculator for 202223. The North Carolina sales tax rate is currently. Search real estate and property tax bills.

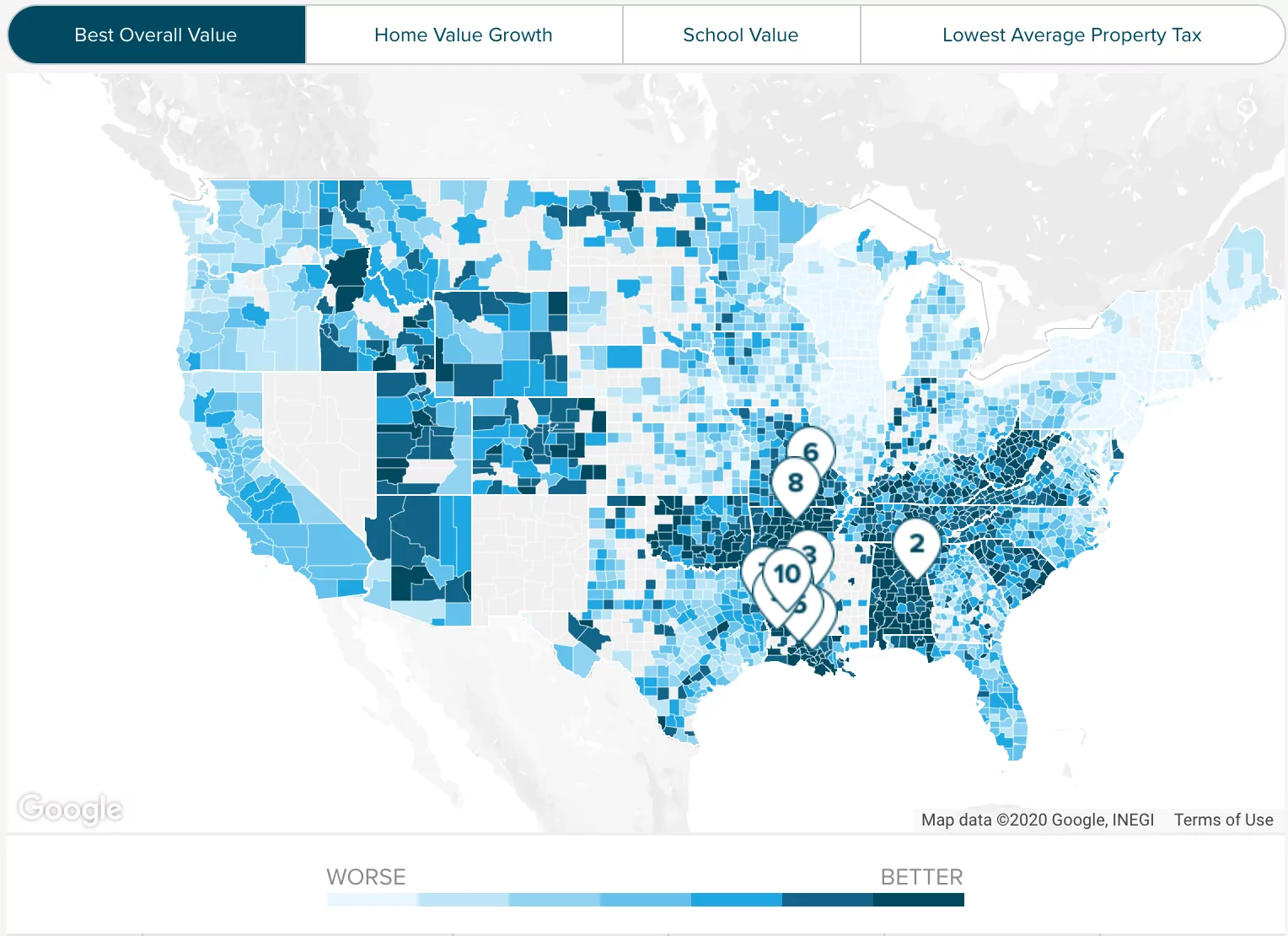

Pay tax bills online file business listings and gross receipts sales. As a way to measure the quality of schools we analyzed the math and readinglanguage. The sales tax rate does not vary based on.

The latest sales tax rate for Raleigh NC. The average cumulative sales tax rate in Wake Forest North Carolina is 725. As far as all counties go the place with the highest sales tax rate is Durham County and the place with the.

For assistance in completing an application or questions regarding the Prepared Food and Beverage tax please call the Wake County. This is the total of state and county sales tax rates. 2000 x 10125 202500.

Maximum Possible Sales Tax. The County sales tax rate is. The current total local sales tax rate in wake county nc is 7250.

Wake County Tax Administration. Your county vehicle property tax due may be higher or lower depending on other factors. This includes the rates on the state county city and special levels.

First we used the number of households median home value and average property tax rate to calculate a per capita property tax collected for each county. Wake Forest is located within Wake County North Carolina. View statistics parcel data and tax bill files.

Did South Dakota v. Maximum Local Sales Tax. The current total local sales tax rate in Wake County NC is 7250.

A single-family home with a value of 200000. The December 2020 total local sales tax rate was also 7250. The North Carolina state sales tax rate is currently 475.

Any municipal vehicle tax assessed in accordance with NC General Statute 20-97 is not subject to proration or refund. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. 2020 rates included for use while preparing your income tax deduction.

The minimum combined 2022 sales tax rate for Wake County North Carolina is 725. Within one year of surrendering the license plates the owner must present the following to the county tax office. Sales Tax Calculator.

If this rate has been updated locally please contact us and we will update the sales. Wake County in North Carolina has a tax rate of 725 for 2022 this includes the North Carolina Sales Tax Rate of 475 and Local Sales Tax Rates in Wake County totaling 25. Proof of plate surrender to NCDMV DMV Form FS20 Copy of the Bill of Sale or the new states registration.

The Wake County North Carolina sales tax is 725 consisting of 475 North Carolina state sales tax and 250 Wake County local sales taxesThe local sales tax consists of a 200. The minimum combined 2022 sales tax rate for Wake Crossroads North Carolina is. Ad Manage sales tax calculations and exemption compliance without leaving your ERP.

To calculate the sales tax amount for all other values use our sales tax calculator above. Sales Tax Table For Wake County North Carolina. Sales tax in Wake County North Carolina is currently 725.

Raleigh Details Raleigh NC is in Wake County. The calculator should not be used to determine your actual tax bill. Learn about listing and appraisal methods appeals and tax relief.

Below is a table of common values that can be used as a quick lookup tool for an average sales tax rate of 725 in Wake County North Carolina.

Taxes Cary Economic Development

Taxes Wake County Economic Development

Taxes Cary Economic Development

How To Calculate Sales Tax A Simple Guide Bench Accounting

File Sales Tax By County Webp Wikimedia Commons

North Carolina Nc Car Sales Tax Everything You Need To Know

Property Tax Calculator Casaplorer

North Carolina Vehicle Sales Tax Fees Calculator Find The Best Car Price

North Carolina Sales Tax Guide For Businesses

Wake County Nc Property Tax Calculator Smartasset

How To Charge Sales Tax In The Us 2022

How To Charge Sales Tax In The Us 2022

Taxes Cary Economic Development

Wake County Nc Property Tax Calculator Smartasset

Is Shipping Taxable In North Carolina Taxjar

7 Ways To Create Tax Free Assets And Income

The Best Worst Months To Sell A House State By State Real Estate Infographic Things To Sell Selling House